How to register a limited company

Grow London Local

Posted: Wed 8th Oct 2025

Thinking about setting up a limited company in London? It's simpler than you might expect and it could give your business the credibility, protection and flexibility to grow with confidence.

In this guide, we explain what a limited company is, who should register and the step-by-step process through Companies House.

You'll also learn what happens after you register – from taxes to bookkeeping, plus tips for success in London's fast-moving business scene.

What is a limited company?

A limited company is a simple way to give your business its own legal life. It can own things, sign contracts and be responsible for its debts.

You can be the only director and shareholder or set it up with co-founders. Then you receive a company number and a certificate of incorporation that proves your company exists.

Key features

Separate from you: the company is a separate legal entity. It has its own money, assets and contracts.

Limited liability: if the company cannot pay its debts, your personal assets are generally protected. You usually only risk what you put into the business, unless you give a personal guarantee or break the law.

Credibility and room to grow: many banks, lenders and bigger clients prefer working with limited companies. It can make opening accounts, winning contracts and building a team easier.

Day to day: money goes into a company bank account. The company pays Corporation Tax on its profits, and you decide how to pay yourself, usually through a mix of salary and dividends.

Who needs to register?

You need to register a limited company if you want your business to operate as a separate legal entity.

That means the company, not you, is responsible for its finances, contracts and obligations.

This option is popular with a wide mix of London entrepreneurs:

Startups and tech founders looking to attract investors.

Consultants and freelancers working with clients who prefer paying a company.

Agencies and creative studios building a team and reputation.

Shops, cafés and service businesses ready to take on premises, equipment or staff.

Registering correctly is important because it makes your business official in the eyes of the law.

Once you're set up, you'll have a company number and certificate of incorporation from Companies House as proof your business is recognised and able to trade.

But if you're not sure you're ready yet, don't worry. Many entrepreneurs begin as sole traders and switch later when their business starts to grow.

How to register with Companies House

Registering your company might sound daunting, but it's easier than it seems. You can do it yourself online in less than an hour, or you can ask an accountant or one of the many online formation services to do it for you.

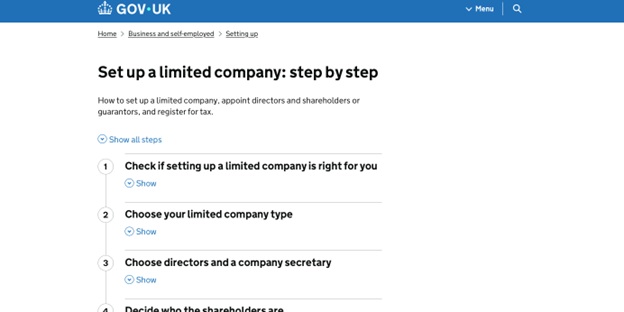

In fact, GOV.UK has a full step-by-step guide to setting up a limited company, which is worth reading through before you start. It explains everything you need, from choosing directors and shareholders to keeping company records.

The good news is that you don't need to have every detail worked out in advance. Some of the jargon (like PSCs and SIC codes) will be explained as you go, and most solo founders can complete the form with their own details.

In London, there's no shortage of accountants and business support firms to get you set up quickly.

Even if you register yourself, it's worth speaking to an accountant early on, as they'll help you keep on top of your accounts and tax returns once you're trading.

Step 1: Choose a company name

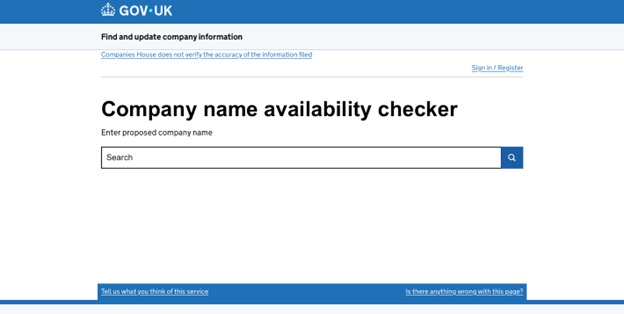

Pick a name that hasn't been taken. Use the free name availability checker.

Step 2: Head to the official registration service

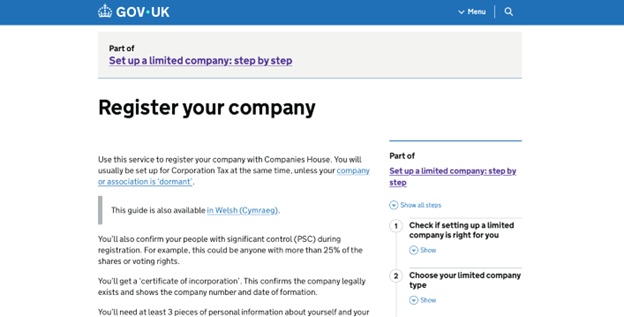

Go to GOV.UK's Register your company page. This is the official Companies House service. Click ‘start now' and follow the steps.

Fee: £50 online.

Timeframe: usually processed within 24 hours.

If you prefer post, use Form IN01. It costs £71 and takes at least a week. Be aware that mistakes on the form or choosing a name that's too similar to an existing company can cause delays, so check everything carefully before you submit.

Step 3: Fill in your details

The form is broken down into simple steps. You're asked for:

Registered office address (home or serviced/virtual office).

At least one director (runs the company, often you).

At least one shareholder (owns the company, often you).

People with significant control (PSC) – anyone owning more than 25%.

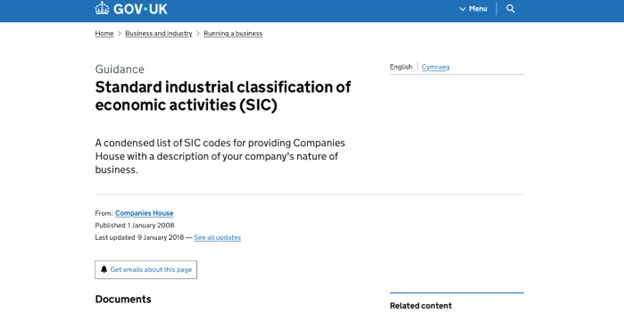

Business activity, chosen from a list of SIC codes.

Review your answers, pay the £50 fee and submit.

Step 4: Get your company documents

If all is well, Companies House will email you within 24 hours with:

A certificate of incorporation: proof your company legally exists.

Your company number: used for bank accounts, contracts and HMRC.

Banks usually ask for both before opening a business account, so keep them safe.

Tips for London entrepreneurs

Be mindful of your address: it's public, so many use co-working or virtual office addresses.

Check your name carefully: London is crowded with businesses, so avoid names too similar to others.

Don't panic about jargon: if you're starting alone, the director, shareholder and PSC will all usually be you.

What to do after you register

Once Companies House confirms your registration, you receive your certificate of incorporation and company number. This makes your business official.

1. Open a business bank account

Most banks in London will ask for your certificate and company number. A dedicated business account keeps finances separate.

Many high-street banks offer startup accounts, so shop around. GOV.UK has guidance on company money.

2. Register for Corporation Tax

You must register within three months of starting any business activity – such as trading, advertising or employing staff. Do this through your Government Gateway account.

Unlike sole traders who follow the April-to-April tax year, your company's financial year starts the day you incorporate and runs for 12 months.

Corporation Tax bill: due nine months after your year end.

Company tax return: due 12 months after your year end.

3. Keep good financial records

From day one, do some basic bookkeeping such as tracking sales, invoices, receipts and expenses. These records feed into:

Annual accounts for Companies House: first due 21 months after registration, then yearly.

Company tax return: due 12 months after your year end.

Corporation Tax bill: due nine months after your year end.

Accountants or software can take the weight off your shoulders, and London has plenty of affordable options.

4. Maintain your company details

Each year, confirm your company's details by filing a confirmation statement. If it's just you, this is straightforward.

You must also keep a PSC (people with significant control) register up to date, recording who owns or controls the company.

5. Think about VAT

If your sales go over £90,000, you must register for VAT. Some businesses register earlier to reclaim VAT on costs.

Helpful reminders

Mark deadlines in your calendar as soon as you register.

Financial year simply means the 12 months from your setup date.

Support is close by: Grow London Local, accountants and mentors can all help you stay on track.

Pros and cons of running a limited company

Running your own company can feel like a big step, and like most things in business it comes with both upsides and challenges. Knowing what these are from the start helps you feel more confident and better prepared.

The positives

Limited liability: personal assets are usually protected if the business struggles.

More credibility: banks, investors and larger clients often prefer limited companies.

Tax efficiency: Corporation Tax is often lower than income tax, dividends are taxed differently.

Flexibility: you can leave money in the company to fund growth.

The challenges

More paperwork: annual accounts, a confirmation statement and a company tax return.

Extra costs: accountants, filing fees and insurance can add up.

Less privacy: some details, like your registered address, are public.

Tips for success

Get the right accountant: more than a bookkeeper, they'll guide you on tax and planning. Read our guide to accounting for small businesses in London.

Stay on top of deadlines: knowing what HMRC and Companies House expect avoids stress and penalties. See our starter's guide to HMRC tax obligations.

Think brand as well as business: in a crowded city, brand matters as much as finances. Learn more about building a brand in London.

Use support available: Grow London Local offers free networking, events and one-to-one advice to help you feel supported.

Conclusion

Setting up a limited company may feel like a lot, but once broken into steps it's clear and manageable.

From protecting your personal finances to giving your business more credibility, it can unlock new opportunities, especially in a fast-moving city like London.

You don't have to do it alone. With the right support, tools and advice, running a limited company becomes far less daunting and much more rewarding.

Read more

Grow London Local: Support for London's small businesses

No matter where you're based in London, you'll find relevant support and guidance on business planning, sales and marketing and much more, as well as opportunities to connect with like-minded business owners. Visit Grow London Local now

Grow London Local

Disclaimer: The content provided on this site, whether by Grow London Local or by third parties, is by way of general guidance only. Grow London Local does not accept any liability for any loss or damage that any person incurs as a result of any content on this site. Please note that where you purchase paid services or content from third parties, your agreement is solely with those third parties.

Never miss a post

Subscribe to our newsletter for the latest insights and updates.

You can view a sample here.

By subscribing you agree to our Terms of Use and Privacy Policy. You can unsubscribe at any time by using the "Unsubscribe" link at the bottom of any email we send you.